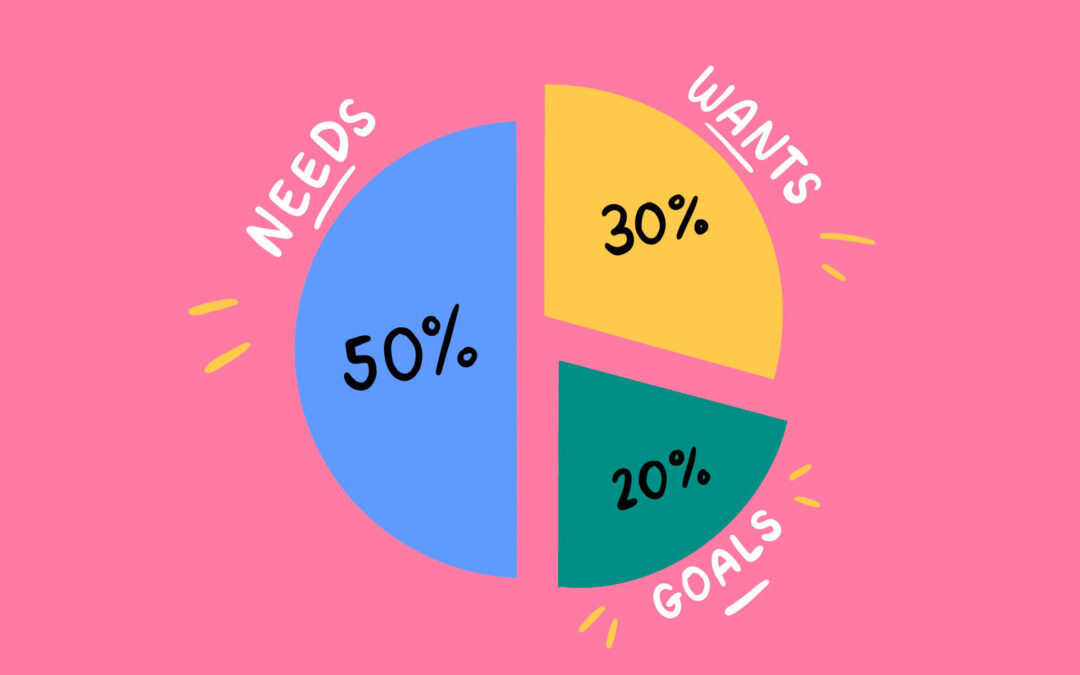

Understanding the 50/30/20

You can divide your budget into three categories—needs, wants, and financial goals—by using the 50/30/20 general rule. It’s more of a general guideline to help you create a sound financial budget than a firm rule.

According to the rule, you should devote up to 50% of your after-tax income to necessities and commitments that are essential to you. The remainder should be divided into 30% for anything else you want, 20% for savings, and 10% each for debt repayment and savings.

The rule is a template designed to assist people in managing their finances and setting aside funds for retirement and unexpected expenses.

Making a monthly budget using the 50-30-20 rule is the first step in allocating your income toward your short-, medium-, and long-term goals. Begin by calculating your monthly after-tax income using recent paychecks. You will be cutting that pie into pieces for your 50-30-20 budget.

1. Required expenses: 50%

Once you know your income, check your bills, including those for rent or a mortgage, a car, gas, electricity, and phone service. Next, determine how much you typically spend on groceries each month. These are the absolute minimums. When you total everything up, if it equals 50% of your take-home pay or less, you’re already on track to stick to a 50-30-20 budget.

You should only require half of your after-tax income to meet your needs and obligations. You will need to either reduce your wants or try to downsize your lifestyle, if you spend more than that on your needs. A solution might be to commute together in a car, use public transportation, or cook more frequently at home.

2. Comfort expenses: 30%

All the things you purchase that are not necessary are considered wants. This includes going out to eat and see a movie, that new handbag, sporting event tickets, trips, the newest electronic device, and ultra-high-speed Internet. If you boil it down, everything in the “wants” bucket is optional. Instead of visiting a gym, you can work out at home, prepare meals, or watch sports on television rather than purchasing tickets to an event.

You can see your spending on entertainment (including cable and streaming services), eating out, traveling, shopping, and self-care on your bank and credit card statements. To understand your average spending and how it compares to your income, look back over a few months. If the reduction is greater than 30%, consider which pleasures you’ll miss the least before making some cuts for the upcoming months.

3. Destined to Savings: 20%

Discipline is needed for the final 20%, which includes saving and paying off debt. It can be tempting to put off saving money and make only the bare minimum payments on your debt each month, especially if you’re starting. But think about Interest rates on credit cards and student loans are frequently high. Debt with a high-interest rate can make it extremely difficult to achieve your financial objectives.

Lastly, try to set aside 20% of your net income for investments and savings. This includes making IRA contributions to a mutual fund account, investing in the stock market, and adding savings to an emergency fund in a bank account.

4. How to make saving and debt repayment a priority

It’s important to take the cost of the debt into account when deciding whether to set aside 20% of your income for savings or debt repayment.

Does your loan have a low or high interest rate, in other words? Perhaps 6% or less is advised if the debt has a low interest rate, with the 20% divided equally between savings and debt repayment. Use most or all of that 20% to pay off high-interest debt first, like a credit card debt.

The 50-20-30 rule is designed to assist people in managing their after-tax income, primarily so that they have money set aside for emergencies and retirement savings. Establishing an emergency fund should be a top priority for every household in case of job losses, unanticipated medical costs, or any other unforeseen financial costs. If a household uses its emergency fund, it should concentrate on replenishing it.

Recent Comments