ADVATS UPDATES

Updates and information relating to your financial wellbeing.

Subscribe to our updates on your favorite social channels.

Safe Ways to Store Cryptocurrency

Investing in Cryptocurrency has gained in popularity in recent years. The importance of safeguarding these assets has grown in tandem with the value of cryptocurrencies. It is critical to take the required steps to avoid losing your crypto assets to fraudsters or hackers.

Retirement Income Strategies You Should Know

You’ve spent your entire working life putting money down for retirement. While saving is vital, managing your retirement resources may be even more crucial. After all, your savings often become your income—transitioning from a saving perspective to a spending mindset can be challenging for many people.

How To Protect Your Business From Fraud

Every company is vulnerable to fraud. This is mainly due to many types of fraud. Cybercriminals modify their tactics as quickly as cyber-security companies develop new products and services. It is impossible to defend against all types of attacks.

Unfortunately, fraud can take many different forms. Some may appear evident, while others are difficult to spot, particularly for the inexperienced eye. And it can sometimes come from within your organization.

What is e-commerce accounting?

Accounting and bookkeeping are critical to establishing sound foundations for any organization, regardless of size or sector. You can only reasonably understand the business’s finances or where it stands in terms of tax liability if you have healthy and precise bookkeeping and accounting practices.

E-commerce accounting is recording, arranging, and managing all financial data and transactions related to an e-commerce company’s operations. Consider it a subclass of small business accounting primarily designed to meet the needs of an e-commerce supplier.

Understanding Succession Planning

Succession planning is creating talent to replace executives, leaders, and other key personnel who leave the organization, are fired, retire, or die. It applies to all businesses in both the for-profit and not-for-profit sectors.

Common Accounting Mistakes and What To Do To Avoid Them

Even in well-organized accounting departments, errors still occur. Despite everyone’s best efforts, mistakes can—and often do—find their way into accounting procedures and cause all kinds of trouble. A reversed entry can result in an unnoticeable error to casual readers, whereas a transposed digit can visibly throw debits and credits out of balance. Because of this, it’s crucial to have a strategy to identify, reduce, and correct errors.

The Importance of Bookkeeping

The Importance of Bookkeeping Businesses require capital to purchase raw supplies, pay personnel, fund marketing efforts, improve technology, and do other critical things. Good bookkeepers are essential for properly managing cash flow in the organization. Small firms...

How to Detect and Prevent Fraud in Business

According to reports, 33% of organizations face an increase in fraud each year. Internal problems like undetected asset theft and embezzlement might expose your company to further financial reporting fraud, resulting in IRS involvement and possible revenue loss.

Fraud in small businesses is a costly, escalating epidemic. The need to safeguard your company from fraud, whether it is committed by staff, vendors, or unidentified people, is an unwelcome reality for small business owners.

What Exactly Is a Thrift Savings Plan?

What Exactly Is a Thrift Savings Plan? TSPs are retirement investment programs available only to federal employees and uniformed military members, including the Ready Reserve. It is a defined-contribution (DC) plan that provides government employees many of the same...

What to Do If Your Company Fails

A company’s failure can be disastrous for its employees, creditors, and suppliers, especially its founders and directors. If you have incorporated your business, you can rest assured that your personal assets will not be jeopardized. However, you will almost certainly have invested significant amounts of your money in the business, and if it fails, all of that will be lost.

How to Make Your Savings Recession-Proof

With rising interest rates and record food and energy prices, a recession in 2023 may be difficult to avert. Preparing for the realities of such a downturn, which may include fewer job possibilities as the economy tightens, continued layoffs, and continued stock market volatility, is a vital step toward weathering whatever hardships lie ahead.

Estate Planning 2023 Checklist

Planning your estate prepares you for traumatic situations like death and disability. Planning can help you avoid unpleasant scenarios, even if thinking about them is never fun. With a well-designed estate plan, you and your family may experience less suffering and better financial consequences than if you hadn’t had one.

What Can You Buy With Cryptocurrency?

Bitcoin has developed as a store of value over the past ten years and has undergone updates to enhance its transaction processing capabilities. Many companies now accept Bitcoin (BTC) as a form of payment, offline and online.

Various goods and services can now be purchased using bitcoin and other cryptocurrencies.

Social Security and Taxes

The amount of your income will determine whether you should pay taxes on your Social Security benefits, which are generally taxable at the federal level.

Because their combined income from other sources and Social Security puts them above the extremely low thresholds for taxes to kick in, most people who receive Social Security benefits should pay income tax on half or even 85% of that money.

Common Retirement Risks

You must be forward-thinking and realistic about your plans to avoid the worst retirement mistakes. Sadly, it needs to be more complex to make poor financial decisions when preparing for retirement. 40% of non-retired adults believe their retirement savings are following the right course, according to the Federal Reserve. However, only some of the 60% who believe they are behind schedule consciously intended to ruin or underfund their retirement.

How to Make a Monthly Budget

While few people enjoy budgeting, the importance of the task is still maintained. A budget allows you to plan for expenses and provides insight into your spending habits, allowing you to curb overspending more easily.

By creating a monthly budget, you can figure out where your money goes, allowing you to set aside money for your goals, such as retirement savings.

Dealing with an Inherited Business

Dealing with an Inherited Business It is a great honor to inherit a family business. However, when there is a leadership void or a failure to plan for estate taxes, the risks of such a legacy can quickly outweigh the rewards. Business owners are often so focused on...

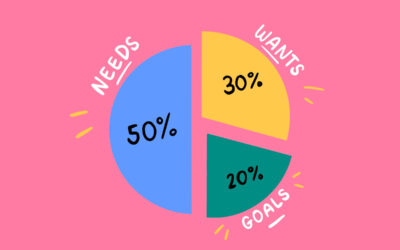

Understanding the 50/30/20

You can divide your budget into three categories—needs, wants, and financial goals—by using the 50/30/20 general rule. It’s more of a general guideline to help you create a sound financial budget than a firm rule.

Cryptocurrency Taxes in 2023

The crypto tax rules remain somewhat complicated. The IRS states that crypto may be subject to income or capital gains taxes, depending on how you use it.

If there is a gain or loss from the sale, trade, or disposal of cryptocurrency, taxes must be paid. You pay taxes on the payment like other assets if you sell or trade the cryptocurrency for a profit. The same holds for non-fungible tokens; any capital gain or loss must be reported for tax purposes.

Tax Deductions for Airbnb Owners

If you’re an Airbnb host, you should know that taxes for home-sharing businesses are similar to real estate rentals, but there are some differences. Airbnb hosts are typically considered rental property owners rather than small business owners for tax purposes.

The way Airbnb hosts deduct expenses differs depending on whether they rent out their entire home or just a portion of it. Some deductions must be calculated based on the number of rental days and the portion of the rented home.

What is a Spousal IRA?

An individual retirement account (IRA) can be funded in the name of a nonworking spouse who has no or very little income using the spousal IRA strategy. This is an exception to the rule that states one must be employed to contribute to an IRA. The total of contributions made on behalf of both spouses must, however, equal or exceed the working spouse’s income.

What Is a Donor-Advised Fund?

A donor-advised fund may appear to be only for the ultra-wealthy, but it is open to anyone who makes charitable contributions. According to Fidelity Charitable, the donor-advised fund is one tax-efficient way to donate money to charities, which has contributed to it becoming the charitable giving vehicle with the fastest growth rate in the United States.

What Happens If You aren’t able to Pay Your Taxes?

Even if they owe nothing, every American who earned money in a given year must file a tax return.; they may be due a refund for taxes already paid throughout the year or may be required to pay additional taxes.

If you do not file your taxes or do not pay the taxes you owe, you may face several serious consequences. The IRS may assess monthly late payment penalties and interest on the amount owed. The maximum amount could be up to 47.5% of what you owe, including 22.5% for late filing and 25% for late payment.

All you need to know about OASDI Tax

The OASDI, also known as Old Age, Survivors, and Disability Insurance tax, is a federal income tax levied in the United States to fund the Social Security program. The tax, like the Medicare program, is part of the Federal Insurance Contributions Act and is automatically deducted from your paycheck.

What Is a High-Yield Savings Account?

High-yield savings accounts help you to earn significantly more interest on your savings than conventional savings accounts do. High-yield savings accounts offer easy liquidity and are particularly advantageous during periods of low interest rates, but they may limit the number of transactions you can make each month and a slow fund transfer process.

Common Estate Planning Mistakes

Estate planning is not the most upbeat subject. You decide who will handle your money and property, who will raise any minor children you have, and who will make health care and make other imporant financial decisions for you if you become incapacitated or die.

Cryptocurrency laws and regulations

Although crypto assets have been around for more than ten years, efforts to regulate them have only recently risen to the top of the policy agenda. This is partial because cryptocurrency assets have only recently transitioned from niche products looking to become more widely used as speculative investments, hedges against weak currencies, and potential payment instruments.

What is Property Tax?

State and local property taxes are typically deductible from the property owner’s federal income taxes. Any state, local, or foreign taxes levied for the general public welfare are deductible real estate taxes. They do not include taxes levied on home improvements or services such as trash collection.

How Does Compound Interest Work?

Compound interest is the interest earned on an investment’s original amount (or principal) plus any previous interest earned. In essence, you are earning interest on top of interest.

What is Asset Location?

Asset location is a tax-saving strategy that takes advantage of various investments receiving different tax treatments. To maximize after-tax returns, an investor uses this strategy to determine which securities must be held in tax-deferred accounts and which in other taxable accounts.

What is Tax Diversification?

Tax diversification is a strategy considering various tax treatments across the investment accounts you will eventually use for retirement income. Because different types of accounts and investments provide different tax benefits, you can gain more control over your taxes by diversifying your investments.

IRS Red Flags to Avoid

Why does the Internal Revenue Service audit some small businesses while ignoring others? What actions can business owners take that may result in a small business tax audit? Sometimes it’s by chance, but certain financial practices can lead to an IRS audit for a small business.

What Is a 403(b) Plan?

A 403(b) plan is a saving type of tax-sheltered annuity (TSA). Employees of tax-exempt organizations are eligible for this type of plan. Employers may include these retirement savings plans in an employee’s benefits package.

The Most Important Retirement Income Sources

What significant sources of income will you have in retirement? What sources of income will you rely on to maintain your ideal standard of living during your “retirement” years? Will you need the support of your children or other loved ones, or do you intend to be financially independent?

As you approach retirement, these are crucial inquiries. Your current income from work, entrepreneurship, or other sources will probably change once you leave a full-time career.

Tax documents you should save

You may only want to keep some of your paperwork after filing your tax return, including your W-2, 1099s, and other receipts. It’s safe to say you don’t want to think about taxes at all. But don’t toss them out as soon as you mail your tax return or submit your electronic forms.

The Internal Revenue Service recommends that taxpayers should keep their documents for three years after the date of filing

Cryptocurrency and charitable giving

Because of the popularity of cryptocurrency, some of the world’s largest nonprofit charitable organizations, ranging from the Red Cross to the Rainforest Foundation, have begun accepting cryptocurrency donations.

Tax Breaks for Environmentally Friendly Businesses

Federal and state governments now allow tax breaks for environmentally friendly businesses. Going green can be a profitable business strategy combined with the potential for increased loyalty from customers who care about sustainability.

Best Locations Outside the U.S. to Retire in 2023

Seniors in the U.S. are increasingly coming up with original and imaginative ways to enjoy retirement on their terms. Senior U.S. expats are fleeing the country in search of a better life and a more affordable cost of living. Many nations are luring U.S. retirees with alluring retirement plans as they quickly catch on.

Estate Planning Checklist

What comes to your mind when thinking about estate planning? You might imagine spending a lot of time in an attorney’s office, huddled over piles of paperwork and immersed in legalese. But the truth is that estate planning doesn’t have to be challenging or time-consuming; with the right help, it can be easier and less expensive.

What is opportunity Cost

In economics, “opportunity cost” refers to the benefits foregone when selecting one course of action over another. It is, in essence, the value of the path not traveled.

Need Accounting Help?

Do you need accounting help? We provide a wide range of accounting services in the Lansdale and Montgomery County PA region.